DOMINIC WINTER AUCTIONEERS LTD

GROUP PERSONAL PENSION

Workplace Pensions form an important part of retirement savings planning, serving as a crucial financial lifeline in our golden years. However, with the cost of living crisis and the constant fluctuations in global affairs, life has become increasingly expensive. It is imperative, therefore, that we take proactive steps to ensure we are saving enough to maintain our current standards of living during retirement.

Within this webpage, you will discover content that you can peruse at your own leisure. We understand that every individual has unique needs and requirements when it comes to retirement planning. You'll also find information on additional benefits you receive whilst being an employee of Dominic Winter Auctioneers Ltd. If there is any specific content that you would like to access but cannot currently find, please do not hesitate to reach out to your HR representative. Should you wish to seek more information on individual Financial Planning services, please contact Bowmore Financial Planning Ltd directly at 01275 462 469 or enquiries@bowmorefp.com.

INTRODUCTION TO STANDARD LIFE

Your current Workplace Pension Provider is Standard Life, a highly reputable and trusted company that has been looking after people's retirement and life savings for nearly 200 years.

One of the key advantages of your Workplace Pension is that it is a Group Personal Pension. This means that you have the opportunity to build up a personal pension pot, allowing you to take control of your retirement savings. With the flexibility to administer your pension as and when you desire, you have the freedom to make decisions that align with your financial objectives and circumstances.

Standard Life not only provides you with the ability to manage your pension, but they also offers a wide range of investment options to choose from. Whether you prefer ready-made Lifestyle profiles or want to select from over 300 funds, you have the freedom to align your investments with your risk tolerance and financial goals. To help you determine your comfort level with risk, Standard Life offers an 'Attitude to Risk' questionnaire on its website. This valuable tool assists in identifying the amount of risk you are comfortable with, allowing you to create a well-diversified portfolio that has the potential to generate attractive returns over the long term. Please be aware that investments can both rise and fall and you could get back less than you invested.

To make managing your Workplace Pension even more convenient, Standard Life offer both a user-friendly online platform and a dedicated mobile app. By simply clicking on the Standard Life logo, you can easily register for access or login to your account. Alternatively, you can download the app from the App Store or Google Play by scanning the QR code, enabling you to conveniently manage your pension on the go.

With Standard Life as your Workplace Pension Provider, you can have confidence in the security and reliability of your pension plan. Their commitment to providing flexible retirement and investment options ensures that you have the tools and resources needed to build a financially secure future.

A pension is a long-term investment not normally accessible until age 55 (57 from April 2028 unless the plan has a protected pension age). The value of your investments (and any income from them) can go down as well as up, so you could get back less than you invested which would have an impact on the level of pension benefits available.

Combine Your Pensions

Don't lose track of your old pensions, consider transferring them into one plan to make it easier for you to administer.

Tracking Down Lost Pensions

If you have lost track of pensions from previous employment, Gov.uk offers tips on how to track these down to manage old policies.

Pension Nomination Form

As you approach retirement, it is important to consider how your income will change and adapt to your future plans. It is crucial to have a comprehensive understanding of your workplace pension, State Pension entitlements, and any other potential sources of income well in advance of your retirement date. Adequate preparation is the key to a successful retirement.

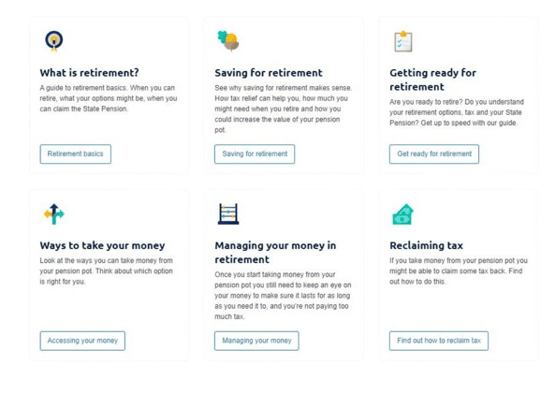

However, when you begin delving into the realm of pensions, you may find yourself overwhelmed by a sea of unfamiliar jargon and terminology. It is not uncommon to encounter terms that you have never come across before, leaving you feeling confused and unsure. Standard Life recognises this challenge, and has put together a bunch of information and explanations of the things you'll need to think about as you approach your chosen retirement age.

THE NEW STATE PENSION

It is important for you to stay up to date with what benefits you are entitled to from the Government, specifically in relation to the State Pension. The 'New' State Pension is what is currently in place and will be relevant to you if you're a man born on or after 6th April 1951, or a woman born or or after 6th April 1953. If you reached State Pension age before 6th April 2016, these rules do not apply. Instead you'll get the basic State Pension.

You'll be eligible for the full amount of the New State Pension if you have 35 qualifying years of paying National Insurance contributions. If you have paid between 10 and 35 years worth of National Insurance contributions then you may be entitled to a proportion of the new State Pension. To view how much State Pension you could get, when you can get it and how to increase it (if you do not have the full 35 qualifying years) you can check your State Pension Forecast on the GOV.UK website here.

The Full State Pension (2023/24) tax year, is currently set at £203.85 per week. If you reached State Pension age before 6th April 2016, you'll get a different amount under the Basic State Pension rules.

RETIREMENT PLANNING AND PERSONALISED ADVICE

For more details on how you can maximise your pension and retirement planning, Bowmore Financial Planning Ltd offer a no-cost discovery meeting with one of our Chartered Financial Planners to determine if our services will be beneficial based on your circumstances and needs.

If professional financial planning is then agreed upon, the cost for our services will be clearly laid out prior to any actions undertaken.

To find out more about Bowmore Financial Planning Ltd you can visit our website at www.bowmorefp.com, or to enquire about our services, please contact Gill or Emily using the details below:

Phone: 01275 462 469

Email: Enquiries@bowmorefp.com

Post: Farleigh House, Farleigh Court, Old Weston Road, Flax Bourton, Bristol BS48 1UR