RETIREMENT PLANNING

As you approach retirement, it is important to consider how your income will change and adapt to your future plans. It is crucial to have a comprehensive understanding of your workplace pension, State Pension entitlements, and any other potential sources of income well in advance of your retirement date. Adequate preparation is the key to a successful retirement.

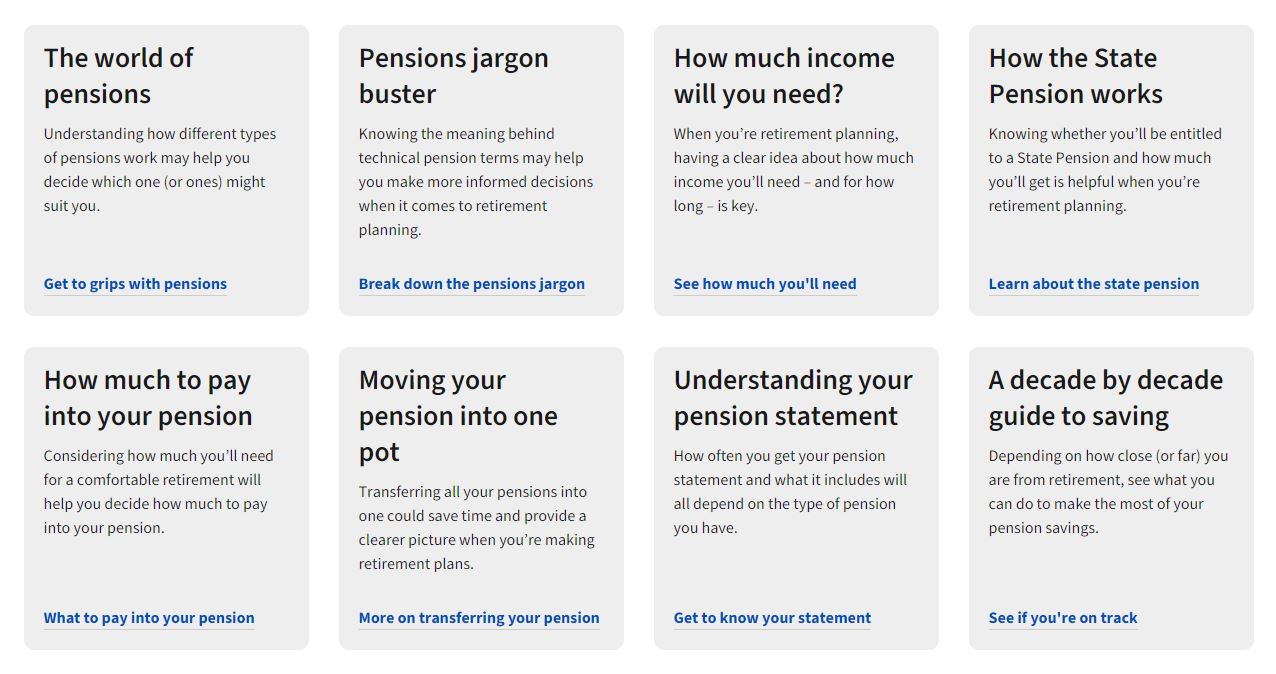

However, when you begin delving into the realm of pensions, you may find yourself overwhelmed by a sea of unfamiliar jargon and terminology. It is not uncommon to encounter terms that you have never come across before, leaving you feeling confused and unsure. Aviva recognises this challenge, and has put together a bunch of information and explanations about some of the terminologies you will come across as you approach your chosen retirement age.

Bowmore Financial Planning Ltd recently ran a workshop with some further information on preparing for your retirement which is available for you to watch below. We recommend those 55+ to watch this. The pension industry is constantly changing, and what is relevant now may not be relevant for those who are due to retire in 10+ years time.

THE NEW STATE PENSION

It is important for you to stay up to date with what benefits you are entitled to from the Government, specifically in relation to the State Pension. The 'New' State Pension is what is currently in place and will be relevant to you if you're a man born on or after 6th April 1951, or a woman born or or after 6th April 1953. If you reached State Pension age before 6th April 2016, these rules do not apply. Instead you'll get the basic State Pension.

You'll be eligible for the full amount of the New State Pension if you have 35 qualifying years of paying National Insurance contributions. If you have paid between 10 and 35 years worth of National Insurance contributions then you may be entitled to a proportion of the new State Pension. To view how much State Pension you could get, when you can get it and how to increase it (if you do not have the full 35 qualifying years) you can check your State Pension Forecast on the GOV.UK website here.

The Full State Pension (2024/25) tax year, is currently set at £221.20 per week. If you reached State Pension age before 6th April 2016, you'll get a different amount under the Basic State Pension rules.

RETIREMENT PLANNING AND PERSONALISED ADVICE

For more details on how you can maximise your pension and retirement planning, Bowmore Financial Planning Ltd offer a no-cost discovery meeting with one of our Chartered Financial Planners to determine if our services will be beneficial based on your circumstances and needs.

If professional financial planning is then agreed upon, the cost for our services will be clearly laid out prior to any actions undertaken.

To find out more about Bowmore Financial Planning Ltd you can visit our website at www.bowmorefp.com, or to enquire about our services, please contact Gill or Emily using the details below:

Phone: 01275 462 469

Email: Enquiries@bowmorefp.com

Post: Farleigh House, Farleigh Court, Old Weston Road, Flax Bourton, Bristol BS48 1UR